Medical Bills

Struggling with medical debt? You’re not alone, and there’s hope for a brighter financial future. Medical bills can feel overwhelming, but with the right strategies, you can regain control and work toward financial freedom. Whether it’s negotiating bills, creating a payment plan, or understanding your options, I’m here to guide you through every step of the process. Let’s tackle your medical debt together and pave the way to peace of mind.

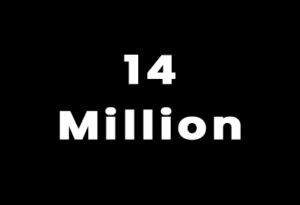

Did you know?

Approximately 14 million adults (6% of the U.S. adult population) owe more than $1,000 in medical debt, with about 3 million (1%) owing over $10,000.

Health Insurance

Even among insured individuals, medical debt is prevalent. About 16.2% of households with full health insurance coverage have medical debt, while the percentage rises to 30.8% for those not fully insured.

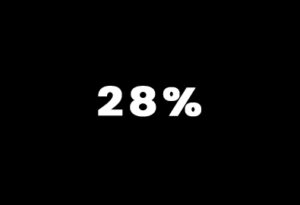

Minorities

Medical debt disproportionately affects people of color, with 28% of Black and 22% of Latino individuals carrying such debts.

Highest Per Capita Rate

The burden of medical debt varies by state. For instance, Hawaii has one of the lowest percentages of adults with medical debt at 2.3%, while states like South Dakota (17.7%) and Mississippi (15.2%) have some of the highest percentages.

Coaching and Tools

The Impact of Medical Debt on Everyday Life

Medical debt is a leading cause of financial hardship, affecting millions of Americans each year. For many, the burden of unexpected medical bills can make it challenging to cover basic living expenses, save for the future, or even maintain a stable income. This type of debt often arises suddenly and disproportionately impacts individuals without robust health insurance coverage, amplifying stress and uncertainty in an already difficult situation.

Solutions and Steps Toward Relief

Despite its challenges, medical debt is not insurmountable. By exploring options such as negotiating bills, setting up payment plans, or applying for financial assistance, individuals can regain control over their finances. Understanding your rights, reviewing medical bills for accuracy, and seeking guidance from financial professionals can pave the way to relief and stability. With the right strategies, it’s possible to reduce or eliminate medical debt and rebuild a secure financial future.

Tools to Use On Medical Debt

Review Bills for Errors and Negotiate

- How it Helps: Medical bills often contain errors or charges that can be negotiated, potentially reducing what you owe.

- Action Step:

- Request an itemized bill and review it for duplicate charges or incorrect services.

- Contact the billing department to dispute errors or negotiate a lower balance, especially if you’re paying out of pocket.

- Pro Tip: Use a service like FairHealthConsumer.org to estimate fair costs for procedures and strengthen your negotiation position.

Set Up a Payment Plan

- How it Helps: Most healthcare providers are willing to arrange interest-free or low-interest payment plans.

- Action Step: Call the provider and ask for an extended payment plan that fits your budget. Many will allow small monthly payments with no penalties.

- Pro Tip: Be upfront about your financial situation and suggest a realistic monthly amount you can commit to.

Apply for Financial Assistance or Debt Forgiveness

- How it Helps: Nonprofit hospitals and some healthcare providers offer financial assistance programs for those with low income or financial hardship.

- Action Step:

- Check if your hospital has a Charity Care program and submit an application.

- Look into government programs or organizations like RIP Medical Debt that may help reduce or eliminate qualifying debts.

- Pro Tip: Even if you don’t qualify for full forgiveness, partial reductions are often available, so it’s worth applying.