Payday Lending

Payday loans can seem like a quick fix, but they often lead to a cycle of high-interest debt that’s hard to escape. For many, what starts as a short-term solution becomes a long-term burden, draining resources and creating financial stress. If you’re struggling to break free from payday loans, there’s hope. With the right strategies and guidance, you can regain control of your finances and build a path to lasting stability.

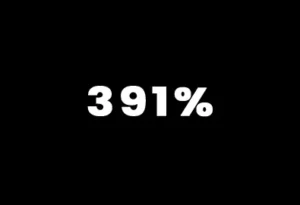

High Interest Rates

Payday loans often carry annual percentage rates (APRs) averaging 391%, significantly higher than traditional loan products.

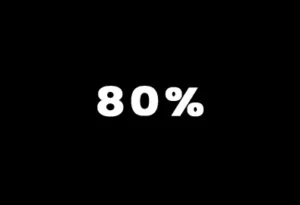

Repeat Borrowing

Over 80% of payday loans are rolled over or followed by another loan within 14 days, indicating a cycle of debt for many borrowers.

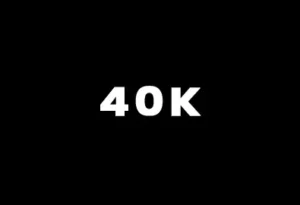

Demographics

Individuals earning below $40,000 annually, renters, and those without a four-year college degree are more likely to use payday loans.

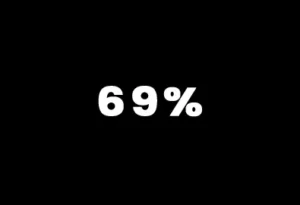

Usage Reasons

Approximately 69% of payday loan borrowers use the funds for recurring expenses like rent and utilities, rather than unexpected emergencies.t

Coaching and Tools

The Hidden Costs of Payday Loans

Payday loans may seem like a quick solution to financial shortfalls, but their high interest rates—averaging an annual percentage rate (APR) of 391%—can quickly trap borrowers in a cycle of debt. In fact, over 80% of payday loans are either rolled over or followed by another loan within two weeks, leaving many struggling to keep up with mounting fees. These loans are often used to cover recurring expenses like rent or utilities, rather than emergencies, which means they frequently target individuals already facing financial hardships.

Build Skills for Long-Term Success

Coaching goes beyond debt reduction—it equips you with the knowledge and tools to achieve lasting financial independence. Learn to budget effectively, plan for future expenses, and make informed decisions about credit and investments. With guidance, accountability, and support tailored to your unique circumstances, you’ll develop habits that empower you to stay debt-free and reach your financial goals faster.

Tools to Use On Payday Lending Debt

Prioritize Repayment to Avoid the Debt Cycle

- How it Helps: Payday loans have extremely high interest rates, and rolling them over can trap you in a costly cycle of debt.

- Action Step: Focus on paying off the loan as soon as possible, even if it means cutting non-essential expenses temporarily.

- Pro Tip: If you can’t pay it off in full, make partial payments to reduce the principal and minimize future interest.

Seek Alternative Solutions Before Renewing

- How it Helps: Other options can provide short-term relief without the high costs associated with payday loans.

- Action Step: Explore alternatives such as:

- Asking for an advance from your employer.

- Negotiating payment plans with creditors or utility companies.

- Applying for a small-dollar loan from a credit union or community bank.

- Pro Tip: Look into nonprofit organizations or local charities that may offer financial assistance for essentials like rent or utilities.

Understand Your Rights and State Laws

- How it Helps: Payday lending regulations vary by state, and knowing your rights can protect you from illegal practices.

- Action Step: Research state-specific laws on payday lending limits, fees, and rollover restrictions. Report any violations to your state’s consumer protection agency.

- Pro Tip: If your lender is uncooperative or charging excessive fees, consider consulting a nonprofit credit counselor to explore debt management options.