Retirement Savings

Building a secure financial future starts with choosing the right place to grow your savings. From traditional savings accounts to retirement plans like IRAs, 401(k)s, and SEP accounts, there are countless ways to invest in your future. Each option serves a unique purpose, whether you’re planning for retirement, saving for education, or building an emergency fund. At The Egg’s Nest, we’ll help you explore the most common savings and investment accounts so you can find the best fit to nurture your nest egg and watch it grow.

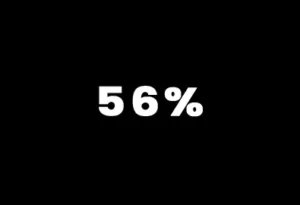

Did you know?

As of January 2024, 56% of Americans would be unable to cover an unexpected $1,000 expense with their savings, indicating a widespread lack of emergency funds.

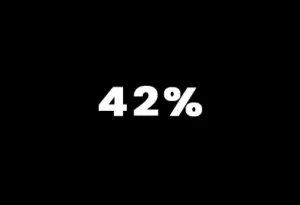

Saving for Retirement

Only 42% of Americans are saving adequately for retirement, suggesting that a significant portion of the population may face financial challenges in their later years.

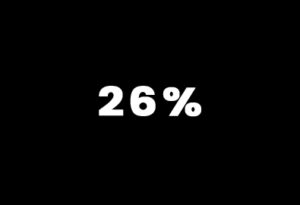

Financial Literacy Goals

In 2025, 26% of Americans aim to improve their financial literacy, reflecting a growing awareness of the importance of understanding personal finance concepts.

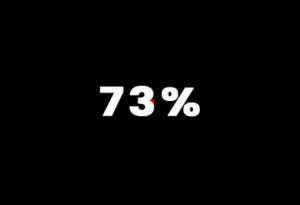

6 Month Emergency Fund

Financial experts recommend that U.S. households maintain an emergency fund covering at least six months of expenses, estimated at approximately $33,000. However, data indicates that 73% of households fall short of this benchmark, with a median savings account balance of only $8,329.

Coaching and Tools

The Importance of Building Savings

Savings play a crucial role in achieving financial security and preparing for life’s unexpected challenges. Yet, many Americans struggle to save consistently, with over half unable to cover a $1,000 emergency expense. Establishing a savings habit, even in small amounts, can provide a safety net for emergencies, reduce financial stress, and create a foundation for future goals. From building an emergency fund to saving for retirement, taking proactive steps today can lead to a more secure tomorrow.

Build Skills for Long-Term Success

Whether you’re just starting out or looking to maximize your investments, there are savings options to fit your needs. Traditional savings accounts are ideal for short-term goals, while high-yield accounts offer better returns. For long-term objectives, retirement accounts like IRAs, 401(k)s, and SEP accounts provide tax advantages and growth potential. By combining the right tools with consistent saving habits, you can work toward financial freedom and achieve milestones like homeownership, education funding, or a comfortable retirement.

Tools to Use when saving

Automate Your Savings

- How it Helps: Automation ensures consistency and removes the temptation to spend money before saving it.

- Action Step: Set up an automatic transfer from your checking account to a dedicated savings account on payday.

- Pro Tip: Use the “pay yourself first” method—allocate a portion of your income (e.g., 10-20%) to savings before covering other expenses.

Set Specific and Realistic Goals

- How it Helps: Clear goals give your savings a purpose, keeping you motivated and disciplined.

- Action Step: Identify your savings priorities (e.g., emergency fund, vacation, down payment) and set a target amount and timeline for each.

- Pro Tip: Break big goals into smaller milestones and celebrate small wins to stay motivated.

Cut Costs and Redirect the Savings

- How it Helps: Trimming non-essential expenses frees up money to boost your savings.

- Action Step:

- Review your monthly budget and identify areas to cut back (e.g., subscriptions, dining out).

- Redirect the money you save into your savings account immediately.

- Pro Tip: Use apps like Trim or Rocket Money to identify recurring charges you can cancel.